If you’re involved in international trade, an EORI number (Economic Operators Registration and Identification Number) is something you cannot afford to ignore. It is a crucial identifier required for customs clearance when importing or exporting goods between the UK and other countries. Without it, your shipments could face significant delays, penalties, or even rejection at the border.

Since Brexit, UK businesses trading with the EU must have a UK EORI number, separate from an EU EORI number. This has added an extra step in the customs process, making it even more vital for businesses to understand EORI registration.

In this guide, we will cover everything you need to know about EORI numbers—what they are, who needs one, how to apply, and the consequences of trading without one. Whether you are a small business owner or a logistics manager, this article will provide clear, actionable insights into EORI compliance in 2024.

Table of Contents

ToggleWhat is an EORI Number?

An Economic Operators Registration and Identification (EORI) number is a unique identifier assigned to businesses and individuals involved in cross-border trade. It is used by customs authorities to track and process shipments entering or leaving the UK.

How Does an EORI Number Work?

- It is required for customs declarations, import/export documentation, and VAT reporting.

- Without it, HMRC (His Majesty’s Revenue and Customs) will not process goods, leading to potential shipping delays.

- The number allows customs authorities to identify businesses quickly, reducing border delays and ensuring compliance with trade regulations.

UK EORI Number vs EU EORI Number

- UK EORI Number: Starts with GB and is required for UK-based businesses trading internationally.

- EU EORI Number: Issued by an EU member state and needed when trading within the European Union.

- Post-Brexit, UK businesses trading with the EU must have both a UK and EU EORI number.

EORI Number vs VAT Number

- EORI Number: Used for customs and international trade.

- VAT Number: Used for taxation and financial transactions.

- Businesses that are VAT-registered may have an EORI number linked to their VAT number, but they are not the same.

Who Needs an EORI Number?

Businesses That Require an EORI Number

If your business engages in any of the following activities, you will need an EORI number:

- Importing goods into the UK or exporting to the EU/other non-EU countries.

- Transporting goods through UK customs as a logistics provider.

- Acting as a customs agent on behalf of other businesses.

Is an EORI Number Required for International Shipping?

Yes. Any business or individual moving goods across borders must have an EORI number for customs clearance.

Is an EORI Number Mandatory for All Shipments?

- If trading within the UK, an EORI number is not needed.

- If shipping goods between Northern Ireland and the EU, a separate XI EORI number may be required.

How to Apply for an EORI Number in the UK?

Step-by-Step EORI Registration Guide

- Check if you need an EORI number (use HMRC’s online checker).

- Gather required documents (VAT number, company registration details, trading details).

- Apply online through HMRC’s website here.

- Wait for confirmation (usually sent via email within a few days).

- Start using your EORI number for customs declarations.

Where to Apply for an EORI Number?

- Businesses can apply directly via HMRC’s website.

- Non-UK businesses can apply for a UK EORI number through a customs agent.

How Long Does it Take to Get an EORI Number?

- Standard processing time: 3 working days.

- Delays may occur if additional verification is needed.

EORI Number Format Explained

UK EORI Number Format

A UK EORI number is assigned to businesses engaged in importing or exporting goods outside the UK. It starts with the prefix “GB”, followed by a 12-digit numeric identifier. In many cases, this number is linked to the company’s VAT registration number, but if a business is not VAT-registered, HMRC assigns a unique identifier.

For example, a UK EORI number may look like this:

GB123456789000

Every UK business involved in international trade must have this number for customs declarations, ensuring goods move smoothly through UK borders. Without a UK EORI number, businesses may face delays, penalties, or the inability to import or export goods.

Northern Ireland EORI Number (XI EORI Number)

Due to the Northern Ireland Protocol, businesses in Northern Ireland that trade with the EU require a different type of EORI number. Instead of “GB”, these EORI numbers begin with the prefix “XI”, followed by the same 12-digit identifier format used for UK EORI numbers.

For example, a Northern Ireland EORI number may look like this:

XI123456789000

The XI EORI number is essential for businesses in Northern Ireland that:

- Trade with the EU and need to comply with EU customs rules.

- Move goods between Northern Ireland and the Republic of Ireland or other EU member states.

- Act as an intermediary or customs representative for businesses trading with the EU.

However, businesses in Northern Ireland that only trade within the UK do not require an XI EORI number.

EU EORI Number Format

For businesses operating within the European Union, the EORI number follows the same structure but starts with a different country code. Instead of “GB” or “XI”, the prefix corresponds to the EU member state where the business is registered.

Here are some examples of EU EORI numbers:

- Germany (DE) → DE123456789000

- France (FR) → FR123456789000

- Netherlands (NL) → NL123456789000

A UK business that exports goods to the EU and is responsible for customs declarations within an EU country will need to apply for an EU EORI number. This is done through the customs authority of the specific EU country where the business operates.

How to Identify an EORI Number?

An EORI number typically consists of three key components:

- Country Code – Indicates the issuing country (e.g., GB for the UK, XI for Northern Ireland, DE for Germany).

- Unique Business Identifier – A 12-digit number that may be linked to a VAT registration.

- Additional Digits (if applicable) – Some businesses with multiple registrations under the same entity may have extra characters added.

How to Verify an EORI Number?

To check if an EORI number is valid, businesses can use:

- HMRC’s EORI Checker (for UK-based numbers).

- EU’s EORI Validation System here (for EU-based numbers).

Verification helps businesses ensure that their trading partners have valid customs registrations, preventing delays in the movement of goods.

Key Differences Between UK, Northern Ireland, and EU EORI Numbers

| Feature | UK EORI Number (GB) | Northern Ireland EORI Number (XI) | EU EORI Number |

| Prefix | GB | XI | EU country code (e.g., DE, FR, NL) |

| Issued by | HMRC | HMRC (for NI businesses) | EU customs authorities |

| Required for | UK import/export outside the UK | NI businesses trading with the EU | Businesses trading within the EU |

| VAT Linkage | Often linked to VAT number | Often linked to VAT number | Often linked to VAT number |

How to Verify an EORI Number?

- Businesses can use the EU EORI validation tool here.

- HMRC also provides an EORI lookup service.

EORI Number for UK & EU Trade

Do I Need an EORI Number If I Have a VAT Number?

Yes, because a VAT number alone is not enough for customs clearance.

Can I Use the Same EORI Number for Different Countries?

No, you will need:

- A UK EORI number (GB) for UK customs.

- An EU EORI number for European customs.

EORI Number Requirements for Importing to the EU

UK businesses that import goods into the European Union must apply for an EU EORI number from the customs authority of an EU member state where they conduct trade. This is necessary because a UK-issued EORI number (GB) is no longer valid for EU customs procedures post-Brexit. Without an EU EORI number, businesses cannot complete import declarations, leading to shipment delays, penalties, or rejection at the border.

Brexit & EORI Number Changes

How Has Brexit Affected EORI Numbers?

Since Brexit, UK businesses can no longer use EU-issued EORI numbers for customs declarations when trading with the EU. Instead, they must obtain a GB EORI number from HMRC for UK imports and exports and a separate EU EORI number from an EU member state if they handle customs procedures within the EU. This change has added extra administrative steps, making it essential for UK traders to register for both numbers when necessary.

New Customs Authority Requirements After Brexit

Following Brexit, goods moving between the UK and the EU now require an EORI number for customs clearance, ensuring compliance with new trade regulations. UK businesses can no longer rely on an EU-issued EORI number and must apply for a GB EORI number for UK trade. Additionally, if a UK business handles customs procedures within the EU, it must apply for a separate EU EORI number from an EU member state to avoid shipment delays and legal complications.

What Happens If I Don’t Have an EORI Number?

Consequences of Missing an EORI Registration

- Customs will reject shipments without an EORI number.

- Importers/exporters may face delays and financial penalties.

- Goods may be seized or held at the border.

Can I Trade Without an EORI Number Legally?

No, businesses that engage in importing or exporting goods internationally must obtain an EORI number before trading, as it is required for customs declarations. Without a valid EORI number, shipments may be delayed, rejected, or subject to penalties, leading to significant disruptions in trade. To avoid legal and financial consequences, businesses should register for an EORI number as soon as they plan to trade across borders.

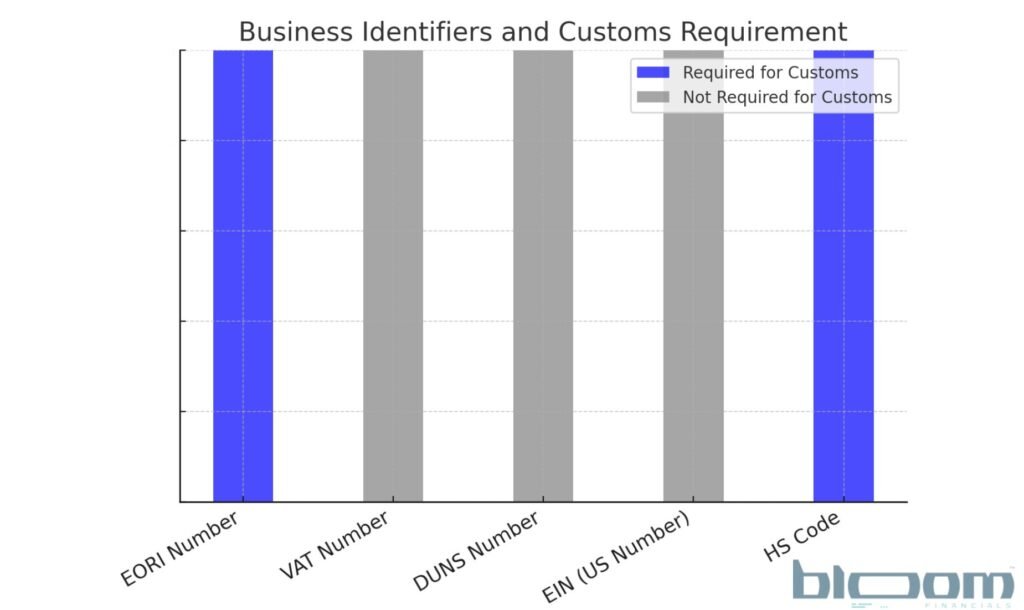

EORI Number vs Other Business Identifications

| Business Identifier | Purpose | Required for Customs? |

| EORI Number | Customs & trade compliance | Yes |

| VAT Number | Tax reporting | No |

| DUNS Number | Business credit profiles | No |

| EIN (US Number) | US tax identification | No |

| HS Code | Product classification | Yes |

How to Verify and Update an EORI Number?

How to Check if a Business Has an EORI Number?

Businesses can verify their EORI number using the HMRC EORI checker for UK registrations or the EU’s validation tool for EU-based numbers. These tools ensure the EORI number is valid and correctly linked to the business for customs processing.

Steps to Update or Change an EORI Status

To update or modify an EORI number, businesses should contact HMRC through their official portal and provide the necessary details. If there are changes in business information, such as a new address or VAT status, an update request must be submitted promptly.

Final Thoughts

An EORI number is essential for UK businesses involved in international trade. Without it, customs clearance becomes a nightmare, leading to unnecessary delays and penalties. Post-Brexit, the need for both UK and EU EORI numbers has become a reality for many traders.

To ensure compliance, apply for an EORI number today and stay up-to-date with HMRC regulations. For further guidance on business finances and compliance, check out related articles on Bloom Financials.